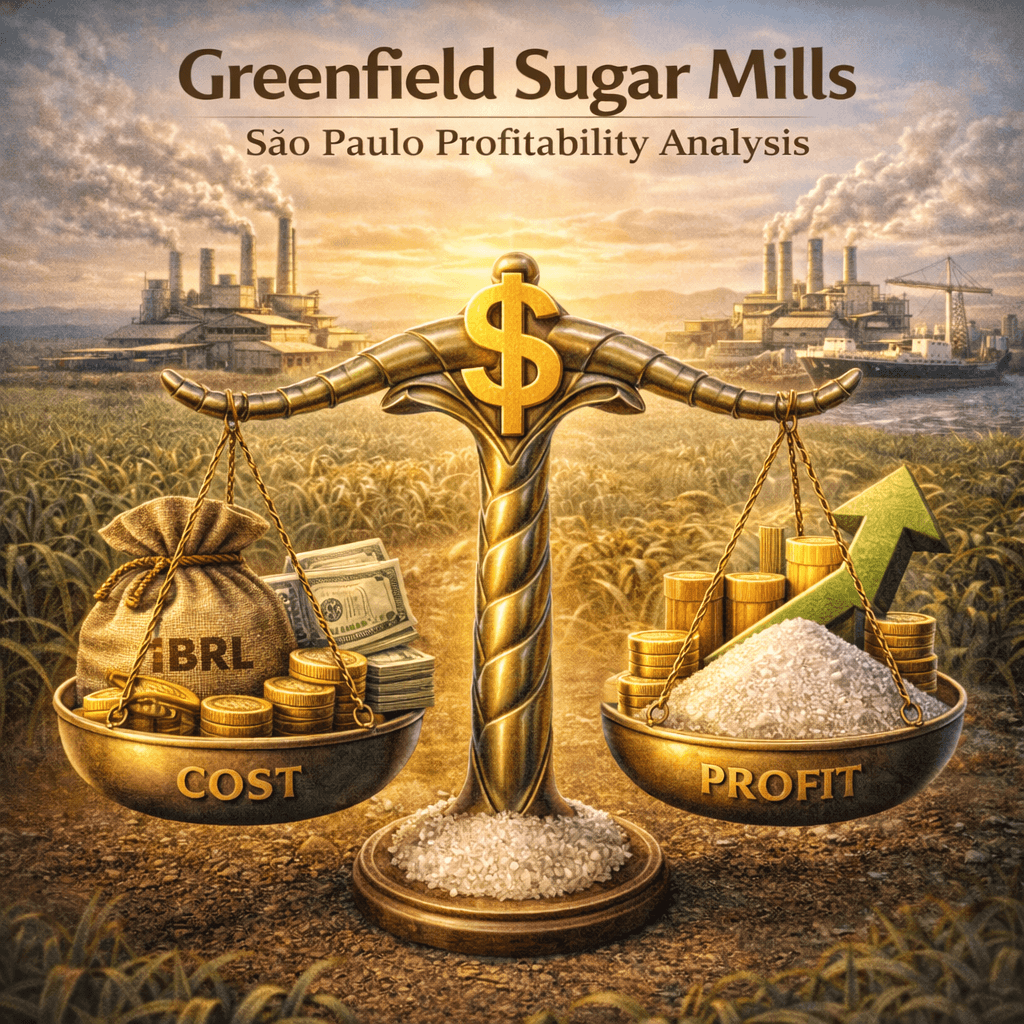

Sugar Mill Unit Economics in São Paulo: The Margin Stack From Cane to FOB

Greenfield sugar mills in São Paulo can work, but profitability is brutally sensitive to sugar price, ATR-linked cane cost, FX, and scale. At mid-cycle pricing, a 3M t/year mill can generate roughly R$150–R$200 EBITDA per ton of sugar FOB, while smaller mills hover near break-even and mega-mills win on unit costs and co-gen uplift.