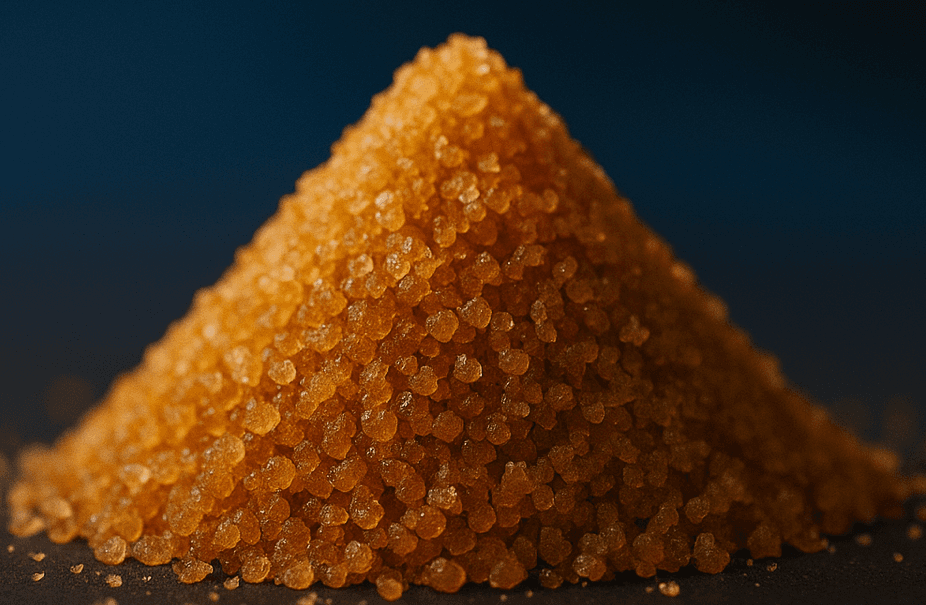

Packed on audited partner lines in São Paulo under Lakay SOP. We own the spec, label, and traceability.

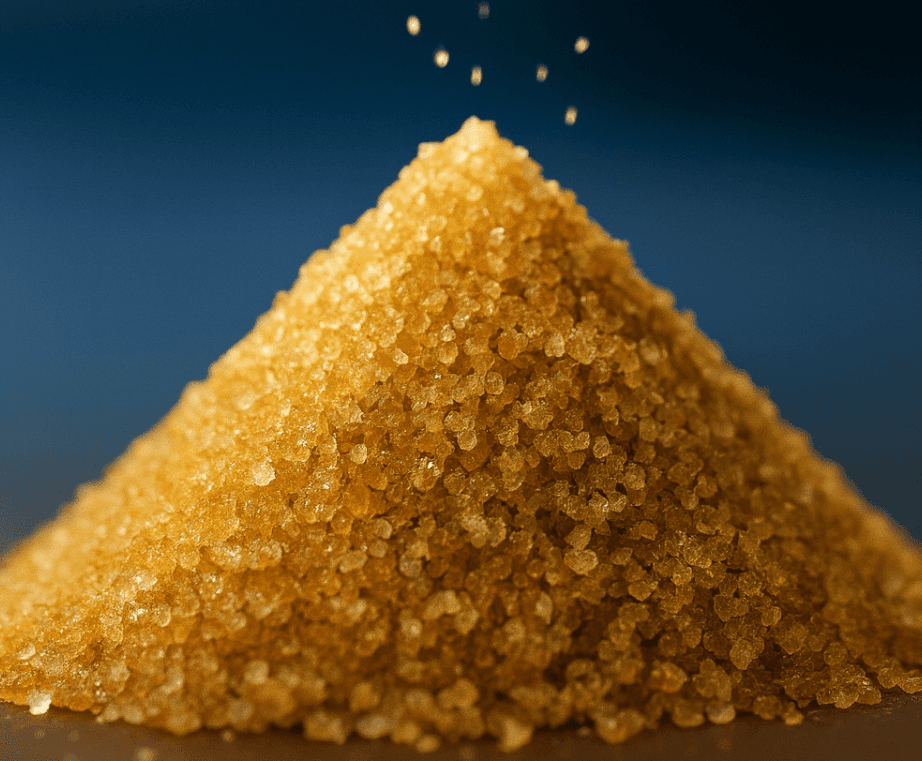

Premium Brazilian Sugar. ICUMSA 45ICUMSA 45 — packed to spec.

COA in our name. QR traceability. Incoterms aligned and bankable docs — DLC / SBLC friendly.

Our sugar portfolio

Four core specs — all producer-grade and traceable to line.

Built for clean shipments

COA in our name; SGS at load. Incoterms aligned, bankable docs, and QR trace on every bag.

Reliable supply, disciplined laycans, and global routings out of Santos and Paranaguá.

Confirmed DLC/SBLC, UCP 600 / URC flows, and bank-to-bank confirmations to de-risk settlement.

Brazil-origin supply. Documentation-first execution.

On-ground packing oversight, disciplined laycans, and paperwork that clears. That’s our operating model.

- Traceable lots with QR on every bag.

- SGS at load; discharge on request.

- Bank-friendly flows (UCP 600 / URC).

What our clients say

Verified sugar buyers. Clean specs, clean documents, on-time vessels.

We purchased two containers of ICUMSA 45 for export to Thailand. COA in Lakay’s name, SGS at load, and paperwork cleared in one go. Very satisfied.

Pricing was competitive and documentation was bank-friendly. Five containers arrived as planned—very happy.

They owned the spec and label with QR trace. Ten containers delivered on schedule. Excellent execution.

Smooth SBLC flow and clean drafts. Five containers consolidated and shipped for Benin without issues.

PI → BL was disciplined. COA in their name, SGS at both ports, and laycan held. We moved from a trial to a rolling contract.

Docs were clean and banks were comfortable (SBLC). Their checklist saved time at customs.

Consistent spec and neat labeling with QR trace. Discharge completed without remarks.

Clear communication and realistic laycan. Minor weather delay flagged early—handled well.

Bank confirmations were smooth and SGS coordination was proactive. Will repeat.

Factory-level pricing and fast doc turnaround. Great partner out of São Paulo.

Latest News

Browse by category: market color, documentation tips, and Brazil-origin updates.

Join the Lakay Business newsletter

No spam—just high-signal notes from Brazil origin: pricing color, SGS/ISO pointers, and new-lane openings.